The German defense industry at a crossroads

Necessary strategic directional decisions for a needs-based and future-proof equipment of the armed forces

Since the NATO summit in Wales in 2014, defense budgets and procurement volumes for new weapon systems have been increasing in Germany and around the world. In the course of digitization, these are becoming increasingly complex and are procured on a multinational basis. The German defense industry must reorient itself and develop future-proof business models in order to cope with the associated challenges in view of a domestic market that has been weak for many years and international competition that has intensified. Despite currently well-filled order books, the industry is at a crossroads. As part of the study "The Future of the German Defense Industry", Strategy& identified four key challenges that companies currently have to overcome in order to increase their competitiveness and secure their future in exchange with leading decision-makers from the industry.

Challenge 1: (Re)building capacities and competencies

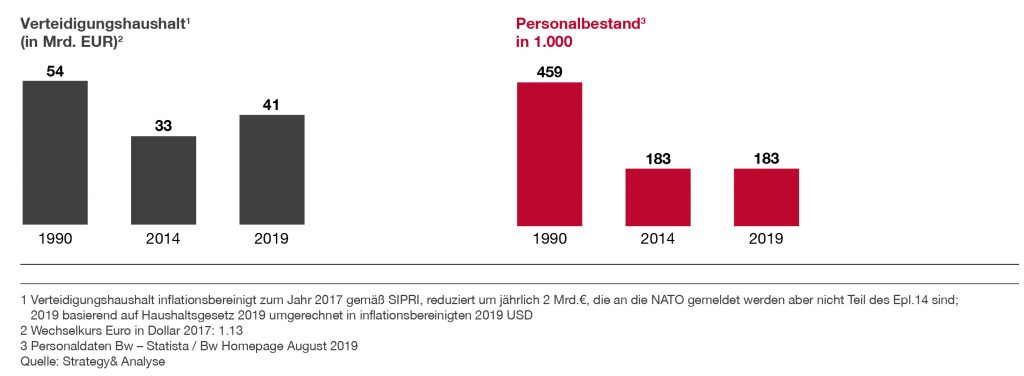

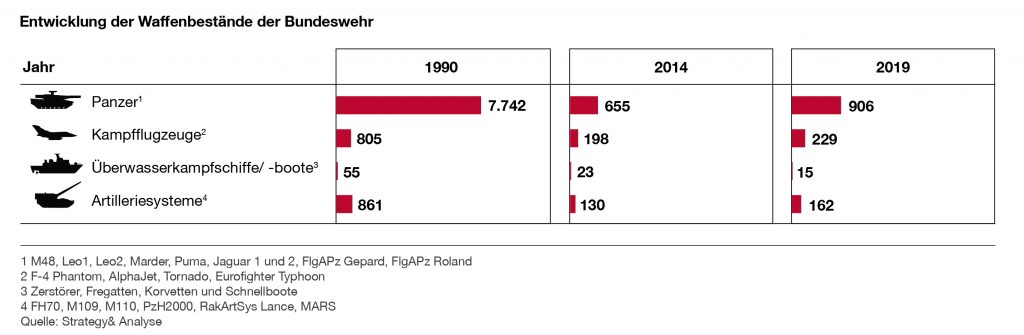

Since the end of the Cold War, the German defense budget has shrunk massively in relation to gross domestic product. As a result, weapon systems and personnel had to be reduced. So skills were lost.

Austerity policies also affected defense industry companies. These focused more on the further development of existing systems or specific niche products. The main new developments since the year 2000 (e.g. Eurofighter, Puma infantry fighting vehicle) have their origins in the Cold War or its offshoots in the 1990s. The German defense industry and the Bundeswehr found themselves in a weakened starting position after decades of capacity reduction and loss of competence when the signs pointed to growth again after the Wales Summit in 2014. The confirmation of NATO's two percent target marked a political and financial trend reversal, as a result of which important key technologies were defined and highly complex, multinational weapon systems were required (e.g. multi-purpose combat ship 180, Future Combat Air System (FCAS), Main Ground Combat System).

However, the implementation of this trend reversal presents the Bundeswehr and industry with the challenge that the industrial base, which has shrunk over the years, is not sufficient to fully advance the large number of complex development and procurement programs that are now pending. There is a lack of resources for skill building. There is therefore a risk that international competitors will try to fill this gap. This would hamper capacity building in Germany in the long term.

Challenge 2: Declining exports due to restrictive export policies

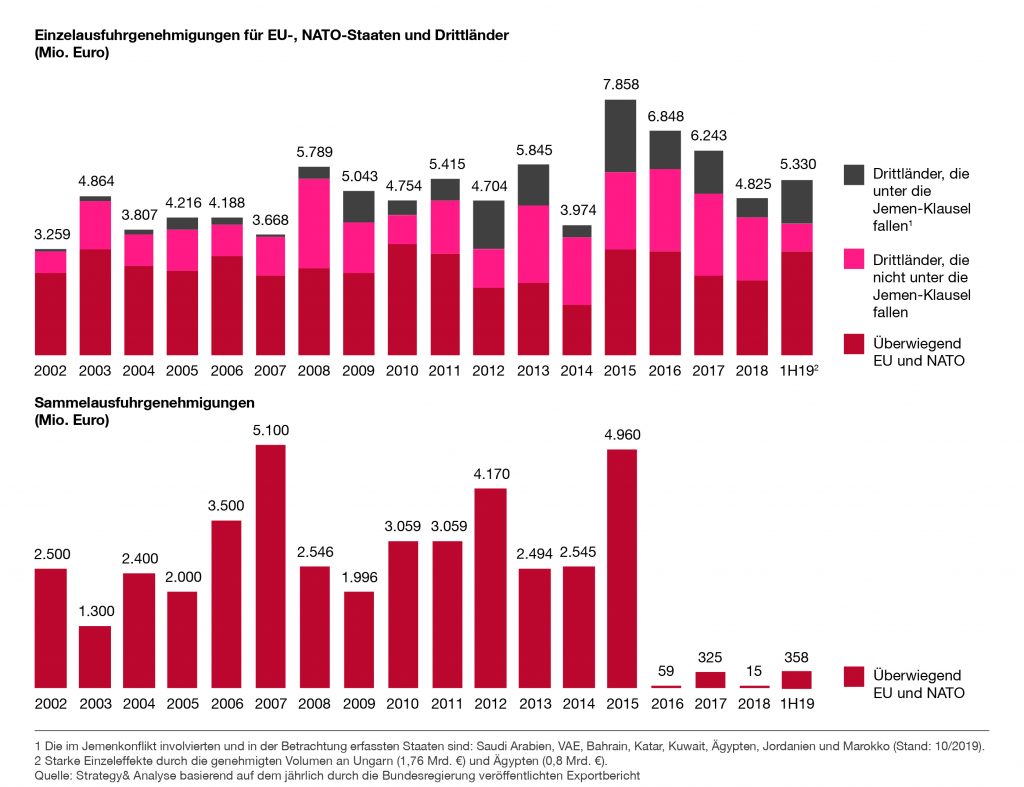

In order to cushion the national market that dwindled after the end of the Cold War, many German defense companies have increasingly concentrated on exports in recent years and delivered products that had already been developed to EU, NATO and third countries. With regard to the newly developed markets, however, the increasingly restrictive export policy of the federal government is presenting the industry with additional hurdles. Despite individual licenses increasing again for the first time in the first half of 2019 (mainly driven by licenses to Hungary in the amount of 1.76 billion euros and to Egypt in the amount of 0.8 billion euros), collective licenses remain at a significantly lower level than in previous years 2016

This export practice jeopardizes international confidence in Germany's ability to deliver. At the same time, innovative, highly complex and internationally competitive weapon systems can only be successfully developed and marketed on an international basis due to the required system capability. Here it is important to achieve EU-wide harmonization of export regulations and a resilient export policy at the political level. Since offset and localization requirements will continue to shape exports, companies must also be able to rely on a resilient export policy from the federal government with regard to the transfer of technology.

Challenge 3: Consolidation pressure from international competition

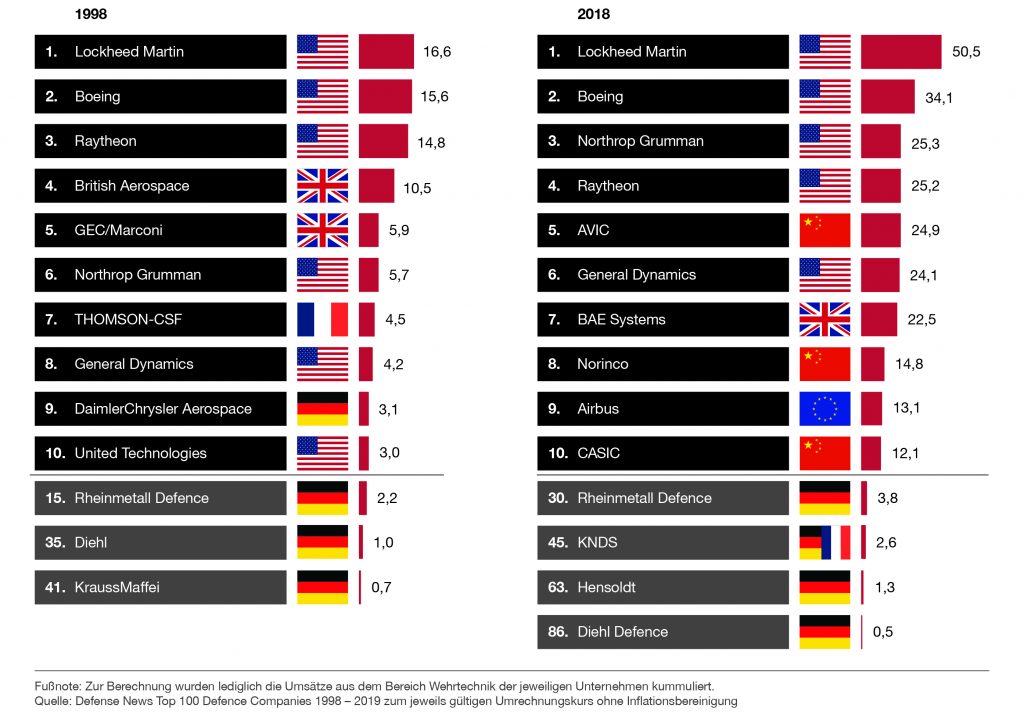

In addition to the restrictions at national level, the international industry structure also poses challenges for the German defense industry. Encouraged by the demand for increasingly complex weapon systems, large international armaments companies such as Lockheed Martin, Boeing, Raytheon and Aviation Industry Corporation of China have grown massively in recent decades both through mergers and organically.

1998 versus 2018

In contrast to this market consolidation, Germany's more medium-sized defense companies have become relatively smaller and have often specialized in technological leadership in niche products in order to serve a comparatively small market. This development harbors the risk that German companies will not be able to scale and innovate to survive the upcoming growth phase in international competition.

Challenge 4: Digitization and networking

With a view to growing digitization, the German defense industry is asked to find answers to the new requirements for weapon systems - for example together with partners. These requirements can no longer be viewed in isolation and independently of IT platforms. The future belongs to cross-sectional information and action groups across all branches of the armed forces, organizational and warfare areas - including cyber. A good example of this is the German-French-Spanish program FCAS, which aims to connect drones, combat aircraft, satellites and command and control aircraft. The German defense industry is currently not yet able to fully provide the necessary system of systems capability and must build this up as quickly as possible in the course of upcoming major projects. In addition to the digitization of products and services, it is evident that the internal processes of defense companies - like most manufacturing companies in Germany - have some catching up to do in the direction of the Internet of Things, Industry X.0 and cyber security. In particular, the digital threat scenario across the entire value chain must be evaluated at an early stage and suitable precautions taken to protect the company.

Fields of action and strategies for the German defense industry

In order to continue to be successful in the market and to grow in the face of the challenges, a conscious alignment of the corporate strategy and the further development of the business models are necessary. We identify two overarching fields of action to be tackled jointly by industry and the state:

Strengthening of existing competencies, capacities and cooperation

With the planned increases in defense budgets (NATO's two percent target) and the definition of key technologies, the foundation stone was laid for developing skills and capacities in the defense industry. In order to be able to deliver for the upcoming major projects, it is now up to the industry to build up or expand technological competence as well as development and production capacities. Of course, this requires planning security for the associated investments. At the same time, European cooperation must be promoted and costs and the number of different weapon systems in the EU must be significantly reduced. The strengthening of existing skills and capacities can be supported by cooperation models in procurement and development. Consolidations can be a possible end result of project and program cooperation, but are not mandatory. On the part of politics, this process must be further improved through the promotion of research and technology, active joint support for exports, the definition and demand for leadership in international programs and the targeted awarding of projects to national champions.

Development of new skills in the course of digitization

In order to develop a system of systems capability, the German defense industry must promote cooperation with established companies, start-ups and research institutions. The aim of this cooperation and mergers is to play a leading role in future multinational armaments projects. For this, digitization must become part of the DNA of the defense industry. This is the only way to ensure that companies can launch new, innovative products with short development times and flexible, needs-based business models. With the founding of the Cyber Innovation Hub, the Bundeswehr has already opened up to the start-up scene and thus enables cooperation with innovative technology companies, e.g. in the field of big data or artificial intelligence.

So far, the value creation of German defense companies has primarily focused on products and services that are based on a complex, physical supply chain, as well as on long-term planned and implemented developments. Short development cycles and quick adjustments to customer feedback or technological developments will be required in the future. New business areas such as the sale of digital services and data based on existing defense know-how can be developed in this way. Accordingly, the mindset of the German defense industry must change and rely on agile development and project management.

Strategies for addressing the fields of action

While politics is addressing the fields of action by adapting the framework conditions and corresponding regulations, the defense industry should deal with these within the framework of systematically implemented strategy processes in order to set the course for the coming years and decades. According to Strategy&'s understanding of strategy, the basis for the development and adaptation of business strategies are the differentiating core capabilities of a company.

Based on a position determination of the current orientation of the company, the analysis of the respective capability system provides the basis for future strategic positioning. In principle, the following six basic strategic orientations are possible. These result from a comparison with other industries and an analysis of the strategic positions of defense companies in other countries.

Global Provider

This strategy is aimed at global coverage of a wide variety of markets and customers in order to support the deployment of the armed forces with integrated product and system solutions, focusing primarily on complex overall systems with system of systems capabilities. Joint ventures are also entered into for the necessary development or relocation of technologies and competencies. The strategy includes the integration of complex supply chains as well as the development of copyrights in third countries in accordance with the applicable export regulations.

Focus on niche products

With this strategy, specific leading products and subsystems are developed. The prerequisite is that companies are technological leaders in selected product segments and operate in markets with selected customer relationships and a comparable requirement profile. The respective company distinguishes itself through its role as a supplier for individually definable products and solutions and can reduce costs through economies of scale. Cooperation with EU and NATO partners enables access to new markets.

Regional focus

This strategy lives above all from national public contracts and focuses on the growing expenditures for procurements by the Bundeswehr and other authorities and organizations with security tasks. Accordingly, the associated business model is primarily based on identifying suitable growth areas and benefiting from increasing national budgets. Due to the focus on customer relationships in the home market, business management is strongly driven by the regulatory and administrative requirements of the client. The safeguarding of existing business areas and the development of new ones takes place through the continuous improvement and expansion of the product portfolio as well as through the further development of the technology to the next higher system level.

operator model

According to this strategy, the company uses its market opportunities through the efficient provision of resources, be it in matters of management, know-how, equipment or personnel. The unique selling point of this strategy lies primarily in the competitive price-performance offers for outsourced services such as the operation of infrastructure and platforms. The operator contracts are usually long-term and are handled both independently and in cooperation with the public sector, at your own or shared risk. New opportunities for this strategy arise from the trend towards performance-based logistics, in which the contracts are no longer defined by the products themselves, but by the actual use of these products, ie flight hours or the availability of systems or spare parts.

Militarization of civilian products

This strategy focuses on demand for individual products, rather than comprehensive solutions, while migrating proven commercial technologies from civil to military use. Since the products and systems offered do not have to be developed from scratch, rapid development cycles and short-term adjustments to customer needs are possible. The market opportunities result from established products and services with a strong price-performance ratio, since economies of scale can usually be used.

Disruptive innovator

The company specializes in replacing traditional business models by serving existing and emerging needs with pioneering technology and alternative business models. Market entry succeeds through digital products and services. The business model behind this strategy is based on using digital platforms wherever possible.

The course for the coming decades must be set now

The result of the strategy process will rarely be the implementation of a strategic direction in its purest form. Rather, these are combined in different forms and priorities to form the company's individual, ability-based strategy. Above all, the future will belong to companies that regularly review their core capabilities, evaluate the current national and international market and technology environment, and react accordingly to future developments at an early stage by further developing their corporate strategy.

authors: Dr. Jan H Willeand Dr. Hans-Jörg Kutscheraare partners at PwC Strategy & Germany.Dr. Jorg SchweingruberSenior Advisor andAndre KellerSenior Manager at PwC Strategy & Germany.